I recently shared some insights from our research on the podcast listening habits of senior executives. Most notably, we found that they are more than 2x as likely as other podcast consumers to be what we call “power listeners,” spending at least five hours a week with podcasts.

That was one of the most widely read blogs we’ve written, especially among brands looking to reach these influential decision-makers and among agencies producing B2B podcasts.

So, we thought it would be helpful to burrow in a bit deeper on the business podcast genre. We wanted to not only understand more about these senior executives but also learn more about the many others consuming business podcasts – including those who have executive aspirations. We did this dive because brands also need to build a relationship with tomorrow’s business leaders who are part of the loyal audience to these podcasts.

Again, we went back to data we have collected in support of the Triton Digital Podcast Metrics Demos+ service. From the more than 12,000 surveys we’ve conducted among monthly podcast listeners in the past year, we looked at 1,245 listeners who listened to a business podcast in the previous month. That gives us a more than robust sample for comparison.

Their Demographics

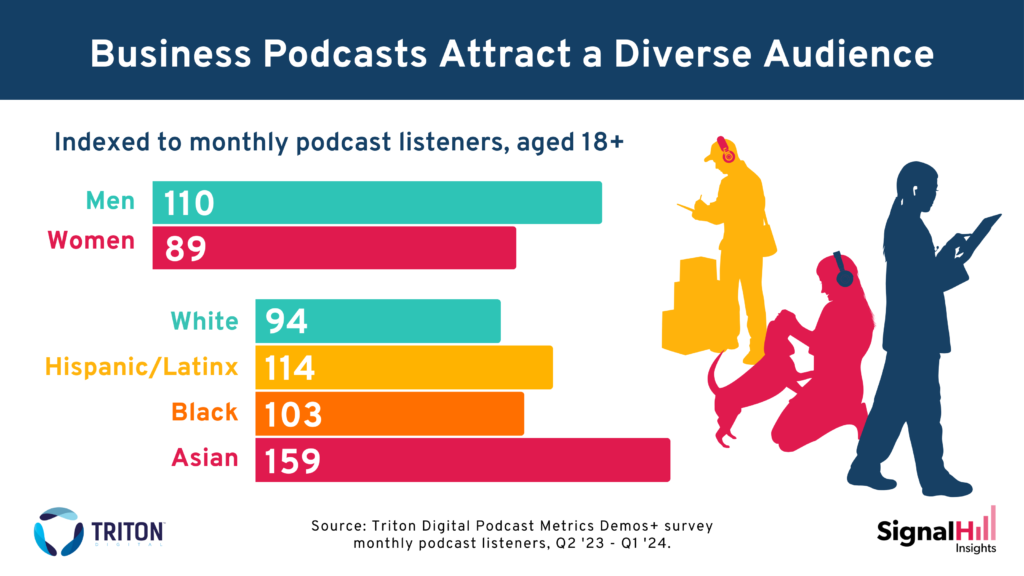

Business podcast listeners represent a surprisingly diverse cross-section of the podcast audience.

Unlike the still largely male enclave of senior executive podcast listeners we checked out in our earlier post (72% men), the business podcast audience is more evenly split by gender, with men indexing only slightly higher than women when compared to podcast listeners in general.

What we found even more striking is the ethnic and racial diversity of business podcast consumers – they over-index among Asian and Hispanic listeners; Black listeners are represented as equally among business listeners as they are in the overall podcast audience, with an index of 103; while business podcast listeners actually index slightly lower among White listeners.

Age splits for business podcast listeners largely reflect those of the podcast audience in general. This even includes 18-24 year-olds who listen to business podcasts in equal proportion to podcast listeners in other age cells.

Why They Listen to Podcasts

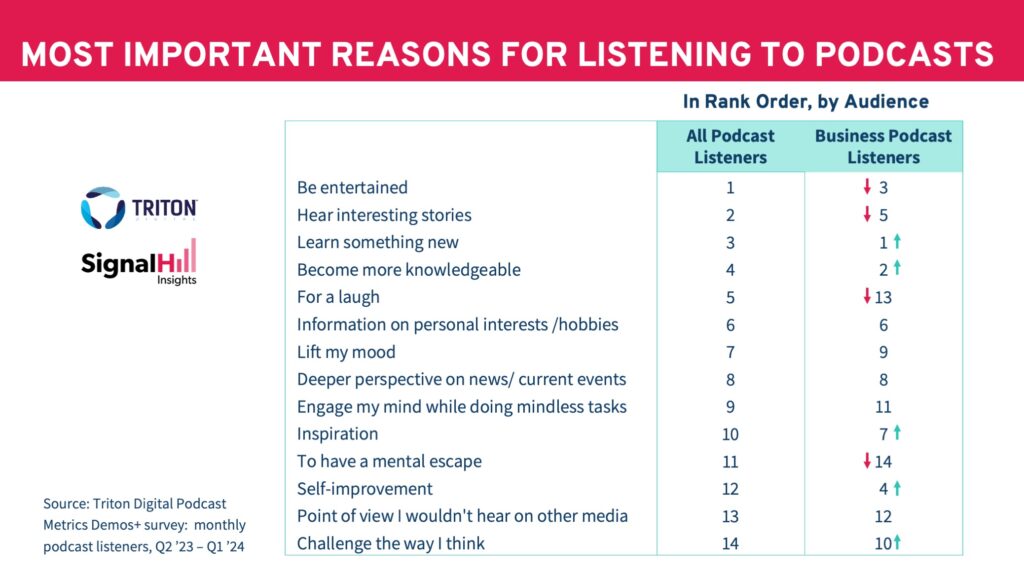

While the business podcast audience extends well beyond the corner office, their reasons for listening to podcasts are remarkably similar to those of senior executives. Compared to other podcast listeners, executives’ podcast listening was less likely to be driven by a need to be entertained, and more by a desire to be informed. We also see this tendency reflected among the broader audience of business listeners. But it goes deeper than that.

Overall, much like the executives, the business podcast audience places a greater priorityl on self-improvement, being inspired, and challenging their own thinking. The table below shows, by rank, the leading motivations for listening to podcasts among all podcast listeners and compares them to the separate hierarchy of needs among listeners to business podcasts.

The Advertiser Verticals That are a Great Match

Consistent with their broad demographic profile, not all business podcast listeners are affluent. While their mean household income is 18% higher than the average podcast listener, fully one-third have a household income of less than $50,000. But that doesn’t mean they aren’t ready to spend on products that address their needs and aspirations.

Business listeners offer an attractive advertiser target for a mix of high-ticket items, products that fuel their desire for self improvement, and others you wouldn’t necessarily associate with business podcasts.

Among the verticals that provide a natural fit for business listeners:

- Travel – Not surprisingly, business podcast listeners are 55% more likely than the average podcast listener to expect to travel by plane for business in the next year.

- Luxury products – Consistent at least with their aspirations, they are 51% more likely to have visited a luxury boutique in the past month.

- Insurance is another leading category, with business listeners being 41% more likely than podcast listeners in general to plan on switching or purchasing car or home insurance, and 31% more likely to plan for life insurance in the next year.

- Fitness – Reflecting both their interest in health and self improvement, they are also 31% more likely to have hit the gym for a work out in the past month.

- Movies – Maybe a little unexpected, but in sync with an active lifestyle, business listeners are 44% more likely than the average podcast listener to go to the movies at least once a month.

- QSR restaurants – Likewise, they are also 30% more likely to visit a fast food restaurant daily.

Reaching Business Podcast Fans Across Genres

Most podcast consumers don’t only listen to one genre, and we can clearly see the business audience’s focus on learning, self improvement and inspiration in the other content they prefer. For instance, business listeners are much more likely to consume technology and education shows than average. That makes these genres and the other genres where they over-index a helpful complement to business podcasts, increasing reach and reinforcing messaging.

Compared to the podcast audience as a whole, business listeners are much more likely to listen to:

- Technology: indexing at 202 (more than 2x that of podcast listeners in general)

- Education: index of 190

- Health and Fitness: index of 172

- Arts: index of 169

- Science: index of 151

Business podcasts and their adjacent genres deliver a diverse podcast audience that goes well beyond the stereotypical executive, yet with many of the same motivations for listening and purchase habits as those executives. That creates an important opportunity for both brands and podcast producers.

Do you have a podcast audience you’d like to understand better? Let us know. We do tens of thousands of surveys among podcast listeners every year. Chances are we have the insights you need.