We’re counting our blessings at Signal Hill Insights as we look back at our audio research in 2023.

One of the many privileges from working on industry research with partners like Sounds Profitable, Triton Digital, and Cumulus Media is the unique perspective it gives us on the ever-evolving audio landscape. In the past year alone, we’ve had the pleasure of surveying more than 40,000 respondents in the U.S., Canada and Australia in support of public-facing audio research studies for these partners and others. This gives us a deep perspective on the audio landscape, filled out by other industry research.

From all this 2023 research, three insights stood out to us as being particularly transformative:

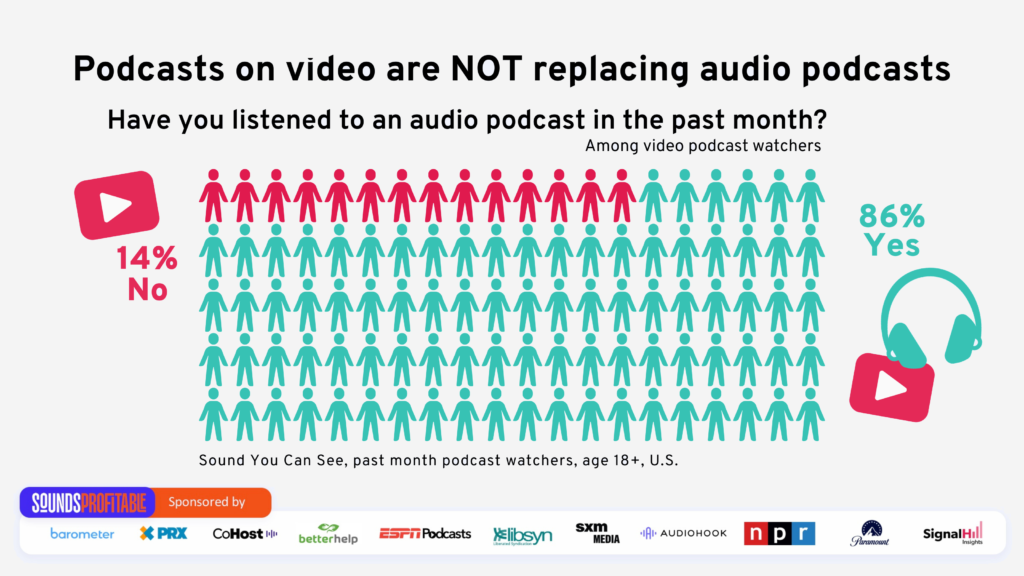

#1: Podcasts on video are not replacing audio podcasts – they are providing another option for podcast consumers.

For the past few years, podcasters have been struggling with what many see as something of an existential crisis. What should we make of the increasing pool of podcast consumers who say they are watching their podcasts on YouTube – making YouTube the leading platform for playing podcasts? Is this the end of podcasts as we know them?

We had the opportunity to probe deeply into video podcasts on several studies this year, most recently on Sounds Profitable’s Sound You Can See, and can put some of those fears to rest.

Most importantly, most podcast consumers who watch podcasts on video also listen to them on audio platforms:

Nearly 9-in-10 podcast watchers (86%) say they also listened to a podcast in the past month. (Sound You Can See, past month podcast watchers, age 18+, U.S.)

More than half of podcast consumers who get their podcasts from YouTube (56%) also listen to the same podcasts elsewhere. (Cumulus Media / Signal Hill Insights Podcast Download Report – Fall 2003 Report, past week podcast consumers, age 18+, U.S.)

Yes, a lot of podcast listeners like to watch their favorite podcasts, but most will also listen when they can’t watch or prefer to listen.

#2: Podcast campaigns have become a must-buy for advertisers, especially to reach younger demos.

This past Spring, Sounds Profitable’s The Medium Moves the Message study painted a clear picture of the growing importance of podcasts as an ad medium, showing its strength at delivering upper funnel, mid funnel and bottom funnel results for its top advertisers.

Collectively, podcasts have become a mass medium, plugging the gaps in linear TV and radio ad campaigns:

- With a past week reach of 50% among 18-34 year olds, podcasts are approaching the 18-34 penetration of network and cable TV at 54% and radio at 59% and delivering on-demand audiences beyond the reach of broadcast media. (Medium Moves the Message, age 18+, U.S.)

#3. Digital audio, including AM/FM streaming, claimed a bigger share of audience and digital ad revenue in 2023.

Audience and ad buying trends point towards a bigger slice of the advertising pie for digital audio over the next few years. We see this in both our research and other respected industry-wide studies that were released this year.

Podcast listening continues to tick up, while podcast ad dollars are growing 2x faster than other digital advertising.

- Year-after-year, more Americans are listening to podcasts. Monthly listening increased from 36% of Americans aged 18+ in the second quarter of 2021 to 40% in Q2 2023, according to our annual calibration survey of more than 8,000 adults for Triton Digital’s Demos+ Podcast Metrics.

- Meanwhile, U.S. podcast ad revenues are growing at twice the rate of overall internet ad revenue, and catching up to consumption. The podcast ad spend increased 26% from 2021 to 2022, and are projected to more than double by 2025, exceeding $4b (PwC | IAB U.S. Podcast Advertising Revenue Study 2023).

Meanwhile, AM/FM streaming is increasing as a share of all AM/FM listening, helping radio land squarely in the digital audio marketplace.

- The share of radio listening going to AM/FM streaming among Americans aged 25-54 doubled from 2014 to 2024, according to Edison Research’s Share of Ear study, going from 10% in Q1 2014 to 20% Q1 2023.

- The trend is similar in Canada – the AM/FM streaming share of all AM/FM listening among 25-54 Canadians has jumped from 11% in Winter 2020 to 17% in Fall 2023, based on our Radio on the Move study conducted with support from Radio Connects.

Why is the growth of digital audio good news for audio in general? It speaks to opportunity. With more of the overall audio audience now listening digitally, they are addressable much like they are on other digital media. This allows digital audio to compete head on with the platforms that attracted ad spend away from radio over the past 20 years. Likewise, unlike analog audio, ad effectiveness for digital audio, including AM/FM streaming, can be measured using online attribution and pixel-based brand lift studies.

Together, these three insights from our 2023 research signal encouraging prospects for audio at large:

- Armed with the knowledge that podcasts on video are not a threat, but rather an additional distribution option, creators can better navigate how to use the video option for their content.

- The emergence of podcasts as a mass medium with meaningful reach – especially with younger audiences – paves the way for podcasting to claim its fair share of ad revenues by being uniquely effective and making advertiser investments pay off.

- Finally, the growth of digital listening gives audio a more prominent seat at the digital advertising table, offering advertisers powerful tools to target audiences and prove out the effectiveness of their audio ad campaigns.

Interested in any other trends we’re seeing in our audio research? Drop us a line.