Black Americans are a vital force within the American podcast audience. Through our research, we’ve been fortunate enough to have an inside track on what they’re listening to, and the types of brands that have an opportunity to leverage podcasts to reach this powerful consumer segment.

Since 2021, Signal Hill Insights has been tracking podcast listening in the US in support of Triton Digital Podcast Metrics Demos+ ― the service that integrates our survey data with Triton’s download data to model comprehensive demographic and sociodemographic profiles for thousands of podcasts.

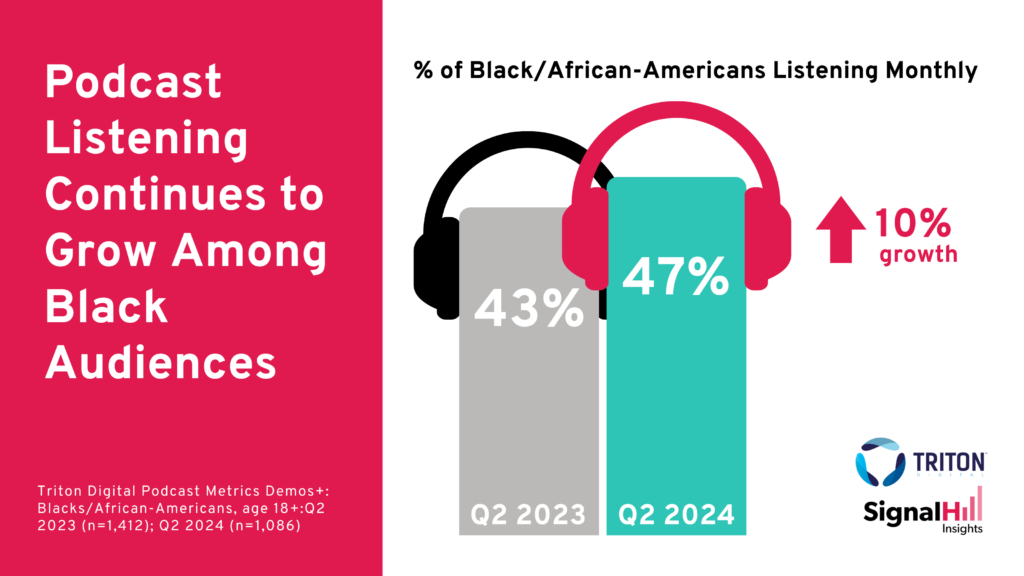

As we enter our fourth year of tracking, we’ve consistently seen Black Americans being more likely than the national average to listen to podcasts at least once a month (all Americans aged 18+). The trend continues in this year’s Q2 survey which shows Black listening up 4 points, or 10%, over last year.

Leading the charge on that growth are new listeners. Looking back at the 24,000+ surveys we conducted among monthly listeners for Demos+ from Q2 2022 to Q1 2024, 46% of Black listeners said they started listening to podcasts in the past year, compared to 42% among podcast listeners in general. More than half (51%) of Black women who listen monthly started listening in the past year.

Distinct Content Preferences

Reaching Black listeners starts with a strategy that speaks to their specific preferences. As you may have seen earlier this year in the Black Podcast Listener Report from Sirius XM, Mindshare and Edison Research, Black listeners are more likely to listen to podcasts with Black hosts.

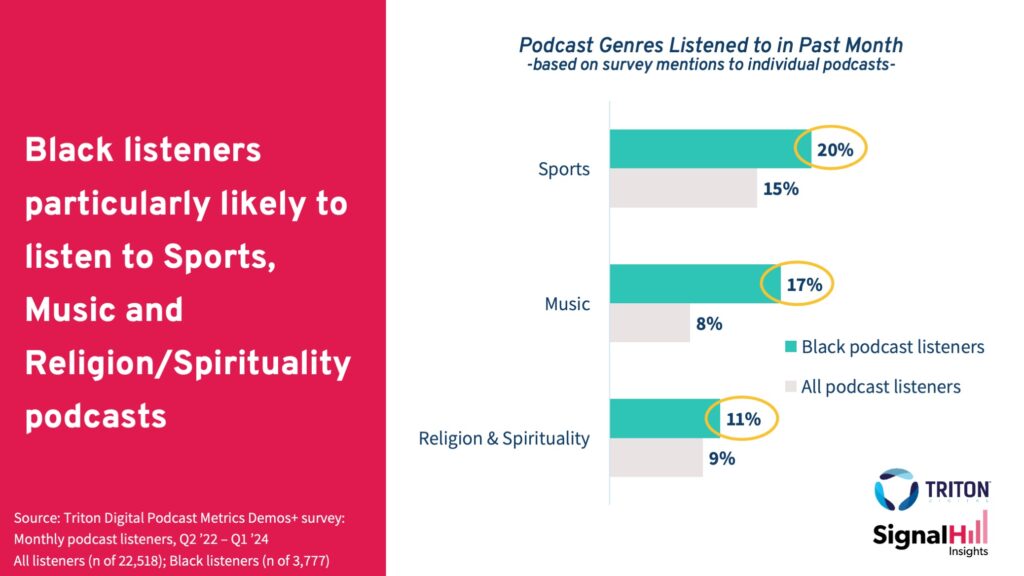

The Black audience also has distinct content preferences that set them apart from the overall audience. Demos+ survey results show they are particularly more likely to choose podcasts from the Sports, Music and Religion/Spirituality genres.

There are clear gender preferences too. As might be expected, far more Black men than Black women listen to Sports podcasts (29% to 6%). Black men are nearly 2x as likely as women to listen to Music shows (23% to 13%), while more Black women than men listen to Religion/Spirituality podcasts (16% to 7%).

Using Podcasts as a Tool for Inspiration and Self-Improvement

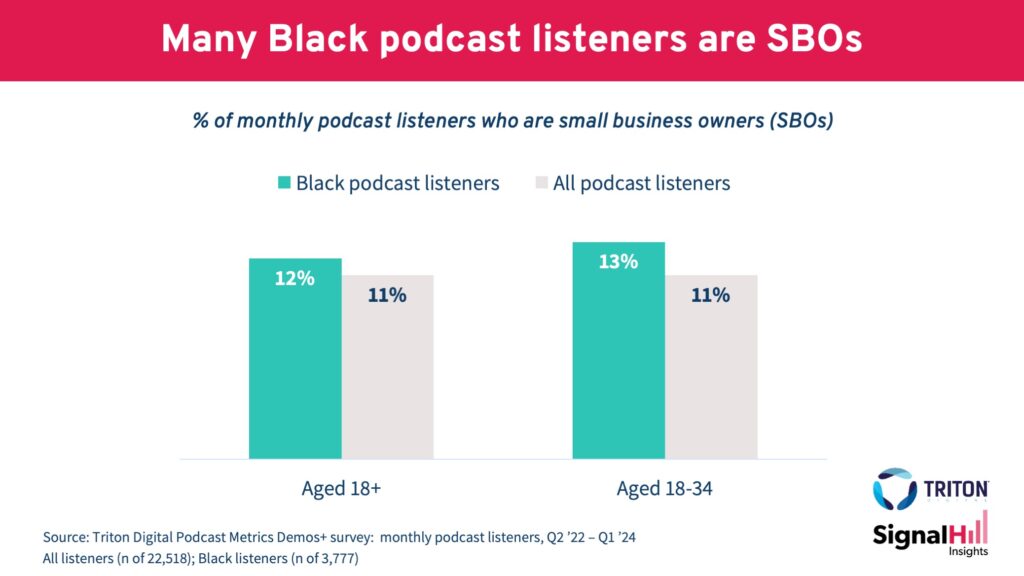

We see this in a tendency towards entrepreneurism. On the whole, Black listeners are slightly more likely to take charge of their work life by being small business owners (12% vs. 11% for podcast listeners in general). And this is even more true among those aged 18 to 34.

In keeping with this entrepreneurial spirit, more Black listeners reported listening to a podcast from the Business and Education genres in the past month than did the overall podcast audience (11% to 10% for both genres.)

In fact, in many ways, the reasons Black listeners give for consuming podcasts mirror those of the Senior Executive podcast listeners we profiled in an earlier blog. Compared to the overall podcast audience, both segments are more likely to say they listen to podcasts ‘for inspiration,’ ‘for self-improvement,’ and ‘to challenge the way they think.’

Category Opportunities for Advertisers

Reflecting a mix of aspirations and practical considerations, here are some of the verticals where Black podcast listeners stand out as a particularly attractive target for marketers:

- Life insurance – 36% more likely than podcast listeners in general to plan to buy in the next year

- Wireless provider – 26% more likely to switch in the next year

- Luxury boutique – 21% more likely to have shopped there in past month

- Quick-service restaurants – 16% more likely to visit at least a few times a week

- Fast fashion clothing stores – 15% more likely to have shopped there in the past month

- Home gym – 11% more likely to have done a workout at home using gym equipment in the past month

If you have a podcast audience you’d like to understand better, book a call. We do tens of thousands of surveys among podcast listeners every year. We could lead you to the insights you need.