In case you missed it, Jacobs Media issued a wake-up call to the radio industry a few weeks ago with the release of their Techsurvey 2022.

Results from the online survey of more than 30,000 listeners recruited from radio station databases across the US and Canada showed a decline in AM/FM tuning, even among these engaged core listeners. As you might expect, that sparked a lot of conversation in blogs and the radio trade publications, most of it expressing the need for action.

We see similar listening trends in our nationally representative studies. Make no mistake: Broadcast radio remains the big dog of all audio, especially the audio accessible to advertisers. However, competition for listener time has grown dramatically over the last couple of decades.

Most important, radio can no longer count on its convenience advantage over its audio competitors.

In-car infotainment systems and Bluetooth are replacing AM/FM radio in the centre of the dashboard. As much as AM/FM continues to be the #1 choice for in-car listening (even in ‘connected cars’), other audio options have become much more accessible.

Radio is no longer the easy and convenient audio option at home either. As much as smart speakers are helping, the clock radio, the kitchen radio and stereo receiver have largely disappeared from most homes.

As the convenience advantage fades, radio needs to attract more intentional listening.

What listener needs does your radio station uniquely serve—or could it serve—in this new competitive environment?

The Need States of Audio

Over the last couple of years, we’ve been taking a wide-angle view of the audio landscape by digging into the need states served by various types of audio.

We explored this recently in Radio on the Move 2022, with support from Radio Connects. In this online survey of more than 4,171 Canadian adults, we compared the need states served by AM/FM radio, podcasts, online music streaming, and owned personal music (e.g., CDs, vinyl, downloaded digital music files).

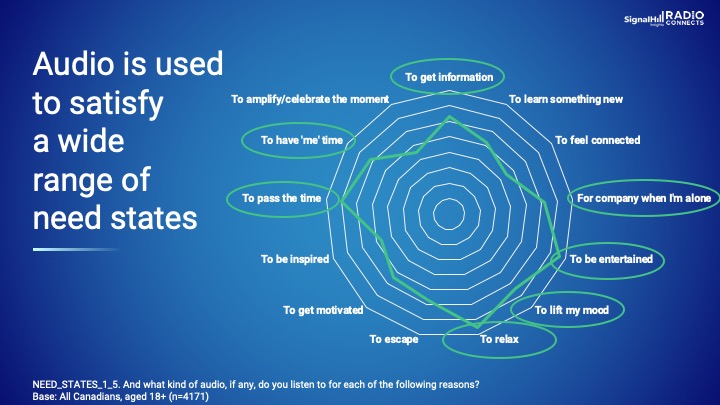

Let’s start with the spider graph below. This looks at the needs Canadians currently look to some kind audio to satisfy. The farther this line moves from the centre to a specific need state on the edge, the more Canadians say they rely on audio to satisfy that need state.

Two things stand out:

- Canadians aged 18+ use audio to serve a diverse array of need states

- Seven of the 13 need states are used by more by 60% or more Canadian adults: #1 is “to be entertained,” followed by “to relax,” “to pass the time,” “to get information, “to lift my mood,” “for company when I’m alone” and “to have ‘me time’.”

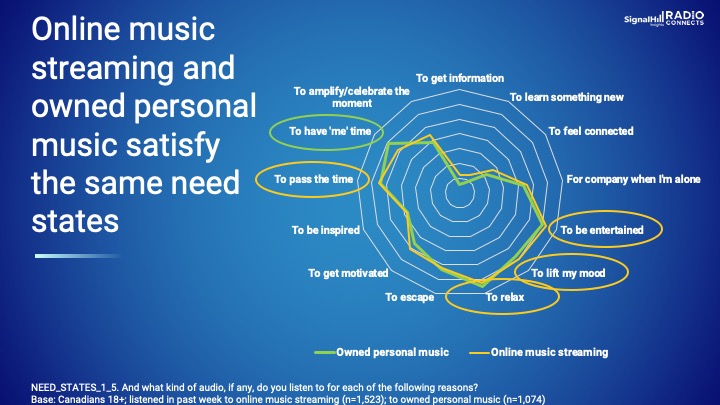

See below for how these need states are met among past week listeners to online music streaming and owned personal music. Notice how both serve a virtually identical set of need states. This suggests that online music streaming is less of a revolution than an evolution, as listeners simply go from owning to renting their music.

Together, music listening satisfies 5 of the top 7 need states.

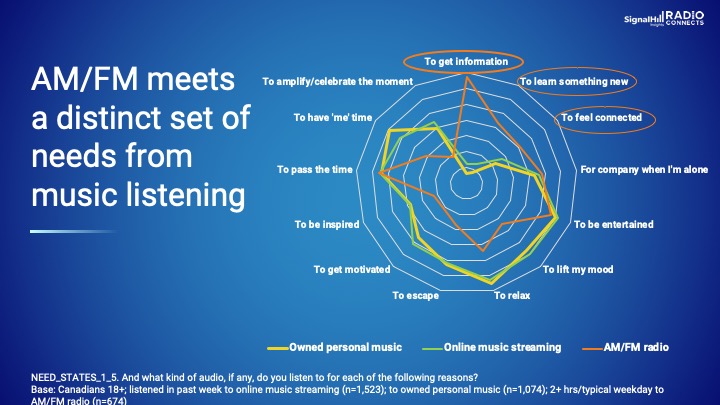

Add AM/FM radio to the mix, as we have below, and you see a distinct profile. Heavy AM/FM listeners (2+ hrs/typical weekday) are much more likely to use broadcast radio “to get information,” “to learn something new” and “to feel connected.”

AM/FM radio competes with music listening on two of the top need states for audio: “to be entertained” and “to pass the time.” Surprisingly though, AM/FM scores only slightly higher than music listening “for company when I’m alone.”

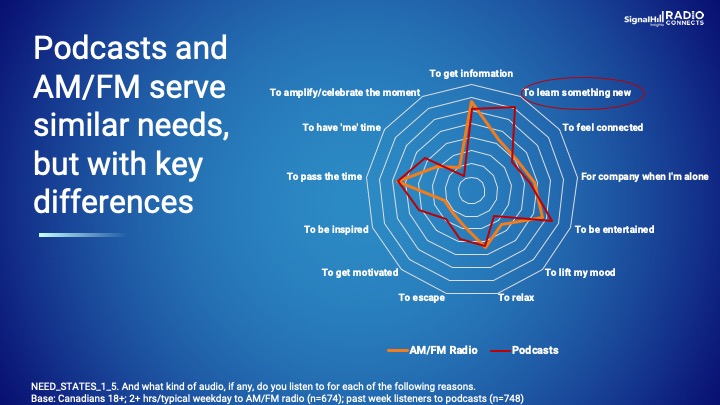

Finally, we compare the need states met by podcasts with the similar set satisfied by AM/FM radio. Reflecting their more specialized spoken word content, podcasts perform particularly well on their superpower of serving the need “to learn something new.”

Takeaways

It’s fair to say that this only scratches the surface of how radio can more effectively compete in the new audio landscape. We’re delighted that both Radio Connects and Jacobs Media have agreed to collaborate with us we dig deeper into this in future Radio on the Move and Techsurvey studies. (In fact, Fred Jacobs joined us sharing similar need states results from this year’s Techsurvey as we presented early returns from Radio on the Move at Canadian Music Week on June 8.)

In the meantime, some points to consider as part of a radio re-think:

- Most important, broaden your competitive horizons. Winning is no longer about taking share from the station across the street. It’s also about competing effectively in the broader audio landscape.

- Determine how to compete better on key need states for the audio consumer.

- Can your station double-down on those need states that are radio’s natural advantages (e.g., “to get information,” and “to feel connected”) or where it’s effectively unchallenged (e.g., “for company when I’m alone?”)

- What can you provide the listener looking “to be entertained” that music streaming services can’t?

- Finally, expand the scope of your local research to include other audio options. The new competitive picture will look different by format and station. In fact, you may find the winner of that format hill or brand image you’ve been coveting may not be a radio station at all.

The full report of Radio on the Move 2022 will be available at the end of June. We thank Radio Connects for its ongoing support of this study, now in its 13th year.

Get audio insights delivered to your inbox!

Signal Hill Insights is an audio research consultancy partnering with publishers, broadcasters and advertisers to tap new opportunities in audio. Our core competency is survey-based research including brand lift studies. Visit us at https://signalhillinsights.com/ or connect with us here.