Over the last couple of years we at Signal Hill Insights have seen rising interest from B2B and other advertisers in reaching small business owners (SBOs). This comes to our attention through our podcast brand lift studies, as we work with agencies, brands and publishers to identify the target audiences for their media and research.

As we dig into background research so we can recommend the most relevant study design, we’ve noticed that some conventional ideas about these segments are being challenged by new realities. Think of an SBO – what does their business look like? Is it a restaurant, a retail store or salon? Or perhaps they’re in tax preparation, landscaping or real estate. No doubt, those all qualify.

But what about driving for a rideshare service, hosting an AirBnB or VRBO rental, or selling goods on a marketplace like Amazon, Etsy, Ebay or Reverb? If you ask the IRS, they’ll consider this self-employment income. Colloquially, we’ve started calling these endeavors “side-hustles,” and these examples only scratch the surface.

Depending on how revenue scales, many of these side hustles are, or close to becoming, full-blown small businesses. The U.S. Small Business Administration only defines a small business by maximum, not minimum, revenue, and the Census Bureau reports 54% have fewer than one employee. There’s a strong case to be made that side hustles qualify.

This is especially true when a side hustle starts to need small business services, from insurance and accounting, to marketing analytics and project management. Moreover, if someone needs to buy business insurance for their side-hustle, wouldn’t you also call them a business decision maker?

(And, just as an aside, how many podcasting businesses started out as side-hustles?)

Some forward-thinking brands have been receptive to this guidance and seen positive lift with the emerging entrepreneurs we are able to identify and survey.

Research Informing More Research: Understanding Podcast Audiences with Side-Hustles

Observing the side-hustle trend, we wanted to investigate further. So we brought this to our partners at Cumulus Media, suggesting that we add it to the Spring 2024 edition of our Podcast Download report. Our question was pretty straightforward: what percentage of podcast consumers have side hustles?

Turns out, about four out of ten weekly podcast consumers have a side-hustle. That’s not an insignificant proportion – it adds up to 42M Americans.

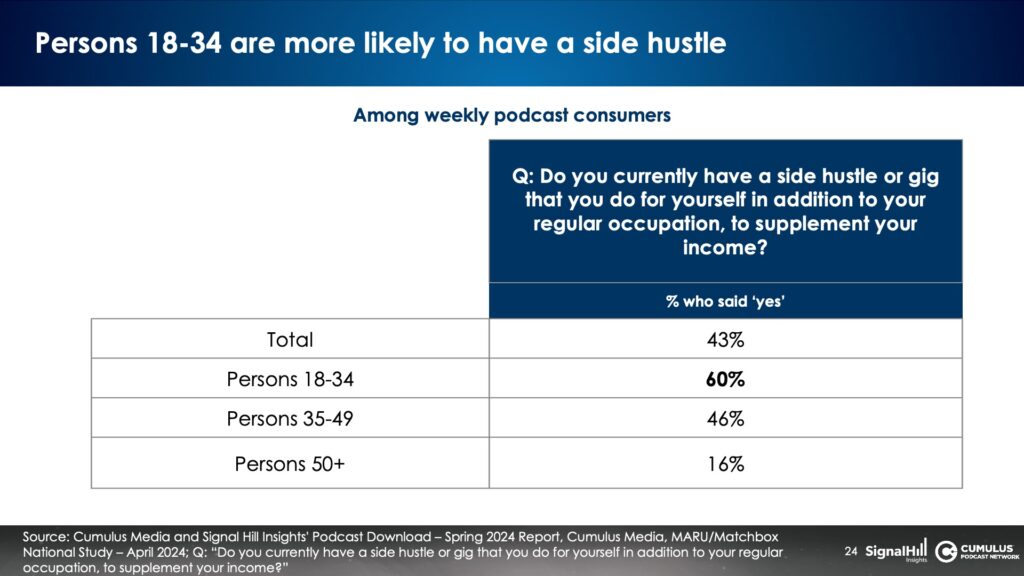

But the story gets even more interesting when we look at the youngest adult demographic. A clear majority of podcast consumers aged 18 – 34 have a side-hustle: 60%. Given that 18 – 34 year-olds constitute 41% of weekly podcast listeners, that adds up to 24M young podcast listeners with side-hustles.

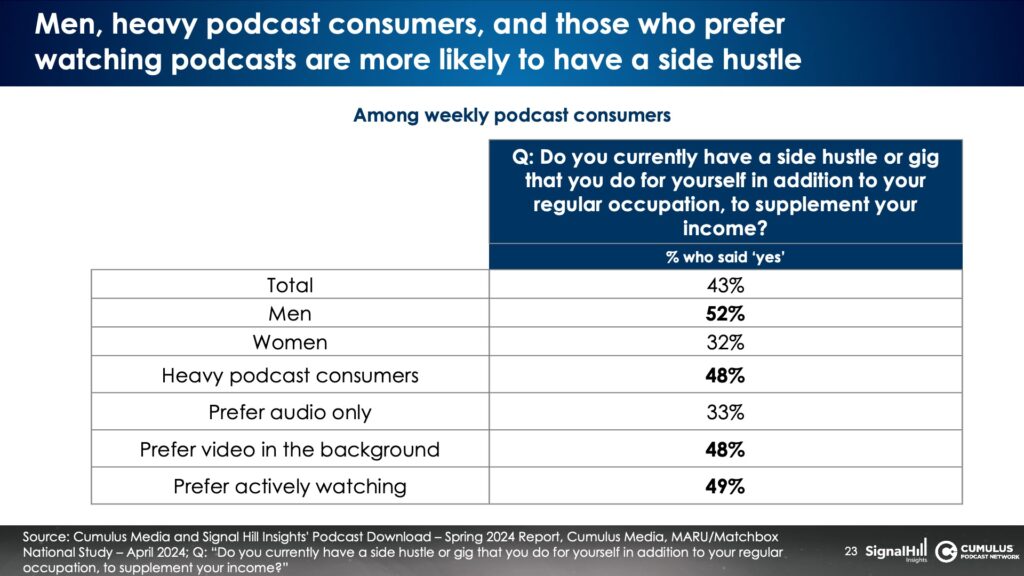

Men, heavy podcast consumers and active video podcast watchers also over-index, compared to the overall podcast audience.

The way I read this is that podcasts are reaching a strong audience of entrepreneurs and emerging small business owners. Of course, not every person opening an Etsy store on the side is going to be operating a full-time business just around the corner. But enough will – or will pivot to a different business – that it’s a very wise investment to begin building mindshare with them now. Even if they don’t need business insurance today, you want your brand to be top-of-mind the minute they do.

A Holistic Research Strategy Connects Brand Lift and Audience Insights

While the side-hustle findings are useful on their own, I want to use this as an exemplar of the holistic approach we at Signal Hill Insights apply to all our research. Whatever the topic or objective, we strive to provide informed counsel to deliver findings that are not mere report cards, but are connected to the broader world.

Too often, ad effectiveness research is siloed and cookie-cutter. The brand’s questions get dropped into a survey template and pushed out to respondents. While it’s easy to understand the need for speed, this approach can restrict the depth, utility, and even validity of the insights. Audiences are made up of real people, not numbers, and understanding audiences is a key input to good brand lift research.

That’s why we see our audience insights studies – with partners like Triton Digital, Sounds Profitable and Cumulus Media, as well as The Canadian Podcast Listener among others – as integral to our brand lift research, not a distraction. In total we’re surveying more than 50,000 audio consumers a year, leveraging that data in everything we do.

The influence goes both ways, as it does with the side-hustle example. Our ad effectiveness work keeps us tuned in to the on-the-ground needs of the marketplace. That provides a road map of topics and business-critical questions that we cycle into our audience surveys. It’s a virtuous cycle.

Do you have a question about podcasts, streaming or radio audiences? We’d love to hear from you.