There’s been a lot of talk lately about hit podcasts.

There’s of course the controversy surrounding podcasting’s megahit, The Joe Rogan Experience. And last month, a Bloomberg article caused a stir in the podcast industry by suggesting that the podcast business has reached an impasse because it isn’t producing enough new hits. The problem, according to the article, is that “there are more podcasts than ever before,” making it harder for new hits to break through.

Sitting here neck deep in podcast data as we are at Signal Hill Insights, we see a different picture. “More podcasts than ever before” = a good thing. Putting the focus on hit podcasts misses the point. Just because ‘podcast’ rhymes with ‘broadcast’ doesn’t mean the same rules apply. ‘Broadcast’ is about providing content with the widest appeal (i.e., the hits); podcasts, with their lower barrier to entry, are about giving listeners content that speaks to them personally and they can’t find anywhere else.

Podcasting’s magic for listeners—and potentially for brands—lies in the long tail.

Wired’s Chris Anderson first drew attention to the long tail 18 years ago back when Netflix was still in the DVD business, when Rhapsody was operating as the first on-demand music streaming service, and one year after Amazon notched its first profitable year by building on the long tail through the power of its online recommendations.

What does the long tail mean? The long tail refers to any scenario where small but numerous activities collectively account for a larger proportion of overall activity than the few large activities or ‘hits’ at the head. A long-tail strategy efficiently aggregates those activities out on the long tail for maximum benefit.

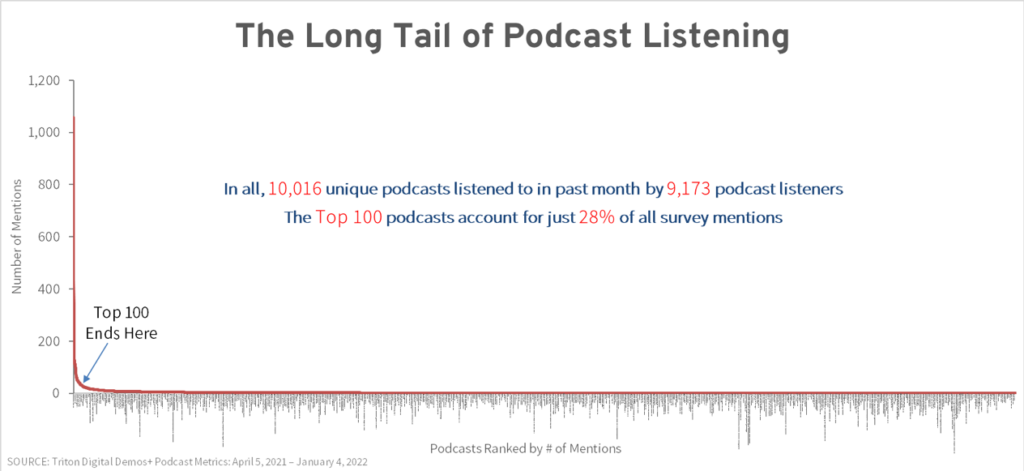

Podcasting is a long-tail medium. We see this firsthand in our podcast listening surveys in support of the Demos+ Podcast Metrics initiative from Triton Digital. The initiative integrates Triton’s census level download data with our survey data to build sociodemographic estimates of individual podcasts well out on the long tail. The 9,000+ US podcast listeners we’ve surveyed so far have named more than 10,000 different podcasts that they have listened to in the past month.

The big hits are a small slice of all podcast listening. The Top 50 podcasts that would have been classified as ‘hits’ in the Bloomberg piece account for only 22% of all survey mentions. Even the Top 100 podcasts (1% of all podcasts named) represent just 28% of all listening. To put this in a marketing perspective: the wealthiest 1% of Americans have 30% of America’s total spending power. Would brands like Tide or Ford market to just this 1%? No!

Take Pinterest as an example of how brands can capitalize on the long tail. Launched in 2010, the virtual pinboarding website greeted its millionth unique visitor in about a year. It was a unique concept that took a while to get going but once it did, increased interest in popular products led to an increased interest in niche products, and producers of niche products identified where their audiences and consumers were hanging out. By 2012, it was responsible for more referral traffic than even Google, YouTube, Reddit, and LinkedIn combined. Usage continues to grow.

Products everywhere are becoming increasingly niche. Podcasting’s long tail, which represents the granularity of podcasting genres and subgenres, suggests it might be one of the few types of media that can tap into the same factors that make niche products successful. In other words, the fact that there is a podcast for every listener potentially means that there is a podcast for every brand.

Your customers are out there, on the long tail, listening to their favourite podcasts.

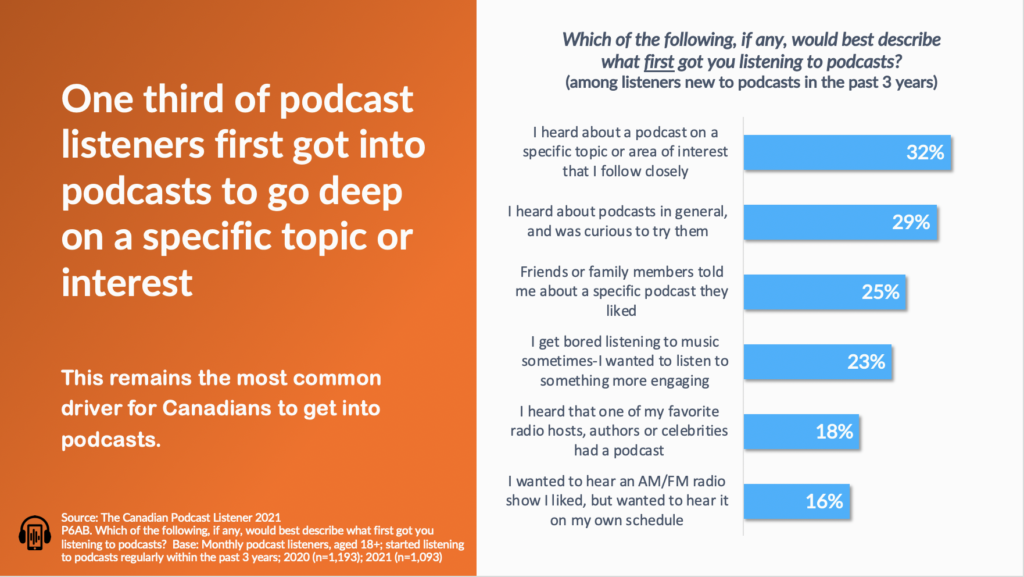

In fact, it’s the long tail that attracts many listeners to podcasts in the first place. In The Canadian Podcast Listener 2021, the leading reason new listeners identified for bringing them into the medium was to get a deeper dive into their personal interests.

New ad tech and better data can bring the long tail within reach of more brands. Building on the success of dynamic ad insertion, the next key step will be development of ‘smart’ programmatic advertising strategies that match the right message and appropriate ad type to the right podcast. This will open up the long tail to more advertisers, bringing more ad dollars to smaller podcasts. Providing more listener data for these smaller podcasts through initiatives such as Triton Digital’s Demos+ Podcast Metrics will also help.

Perhaps even more important, improved recommendation and better search engines will help to solve podcast discoverability and make the long tail more accessible to listeners and uniquely advantageous to marketers.

As listeners discover the magic of the long tail of podcasting, brands will follow.

See you out on the long tail!

The Canadian Podcast Listener 2021 is co-published by Signal Hill Insights and Jeff Ulster, with support from The Podcast Exchange (TPX). Results are based on online surveys using a market representative sample of more than 4,500 Canadian adults from Maru Voice Canada.

If you’d like to know more about our brand lift studies or our other audio research, check out our Brand Lift Studies page at https://signalhillinsights.com/research/brand-lift-study/

Matt Hird

Matt has spent the last 13 years diving into data for radio, podcasting, television, out-of-home and digital media. Matt has a passion for sharing new insights, listening to podcasts and eating way too much pizza.