While insulated from much of the disruption of the pandemic, podcast listening has been facing its own set of changes over the past couple of years.

It was only a year and a half ago—two months into lockdown—that Joe Rogan took his $100 million payday from Spotify. Since then the pace of consolidation and acquisition has only picked up. Not to mention the explosion in the number of podcasts available to listeners. Once we got to 2 million—well, I think everyone pretty much stopped counting.

All that change, plus the potential impact of COVID, has us eagerly digging into the early results from the latest Canadian Podcast Listener study.

Now in its fifth year thanks to the support of The Podcast Exchange (TPX), The Canadian Podcast Listener is a big study: an initial survey each year among more than 3,000 adult Canadians, followed by the main survey of 1,600 monthly podcast listeners looking at the podcasts they listen to as well as changes in how they’re listening. We were in field the first three weeks of October.

Here’s what we’re seeing so far:

More Canadians are listening to podcasts as we come out of COVID

- Continuing the incremental 5-year growth trend, monthly podcast listening is up by two points from October 2020.

- Weekly podcast listening is up even more as more Canadians make podcast listening a regular habit, rising from 18 to 21% of Canadian adults.

- Podcast listening in French Canada, long lagging behind that of English Canada, is up most sharply as more French-Canadian content becomes available, with weekly listening spiking from 12 to 18%.

- Audience composition has largely held steady, with listening growing across all demos. Here’s the current profile of monthly podcast listeners: 47% are aged 18-34; 35% are 35-54 and 18% 55+. Meanwhile, by gender, 54% are men; and 46% are women

Podcast listeners are spending more time with podcasts

- “Power Listeners,” who account for the lion’s share of all listening, are on the rise. In 2019, Power Listeners represented 26% of monthly podcast listeners, up to 28% in 2020, and now 31% of all monthly listeners.

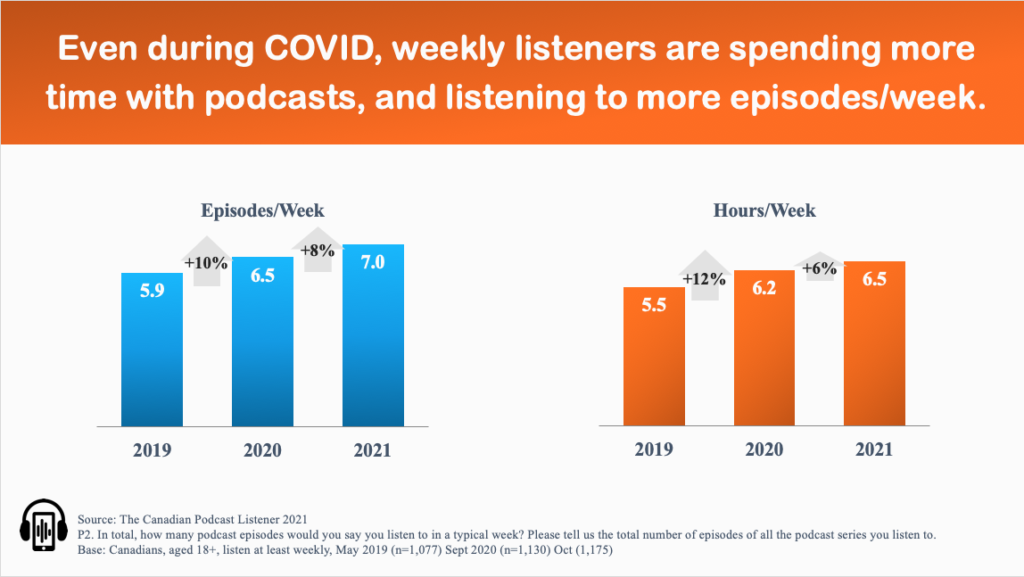

- Meanwhile, average time spent listening to podcasts by weekly listeners keeps growing, now up to an average of 6.5 hours a week.

- Weekly listeners are also gobbling up more episodes a week, up an average of more than one episode a week since 2019.

The shift to at-home listening we saw earlier in the pandemic is holding

- Could COVID have resulted in a permanent shift in location of listening? On average, the proportion of reported podcast listening at home jumped from 60 to 68% last year. That’s held steady at 68% this October, even as things are opening up post-pandemic.

- On a related note, the shift of podcast listening to smartphones has stalled since last year. After growing from 66% to 70% of time spent listening to podcasts in 2020, mobile devices slipped back to 69% this year. Smart speakers picked up the slack, moving from a 3% to a still tiny 4% share of all listening.

Spoiler alert: Other big changes are afoot in how Canadians are listening to podcasts

The podcast landscape has changed dramatically since we launched our first Canadian Podcast Listener study in 2017.

The continued growth of podcast listening has attracted significant investments from large multinational companies such as Spotify, iHeartMedia and SiriusXM/SXM Media and, more recently, Amazon and Facebook. The latest development comes from YouTube who just hired someone to lead their podcasting efforts. Canadian publishers and advertisers are also upping their game when it comes to podcasting. With these new dollars come new types of content, platforms and technology that are transforming the way people are listening to podcasts.

As we dive deeper into this year’s data, we are seeing signs of the powerful impact these changes are having and what they could mean for podcasters and podcast advertising. We look forward to sharing some of those insights with you over the next few months.

The Canadian Podcast Listener study is co-published by Signal Hill Insights and Jeff Ulster, with support from The Podcast Exchange (TPX). Results are based on online surveys using a market representative sample of more than 4,500 Canadian adults from Maru Voice Canada. A free summary report of key findings from the 2021 study will be available at canadianpodcastlistener.ca at the end of November.